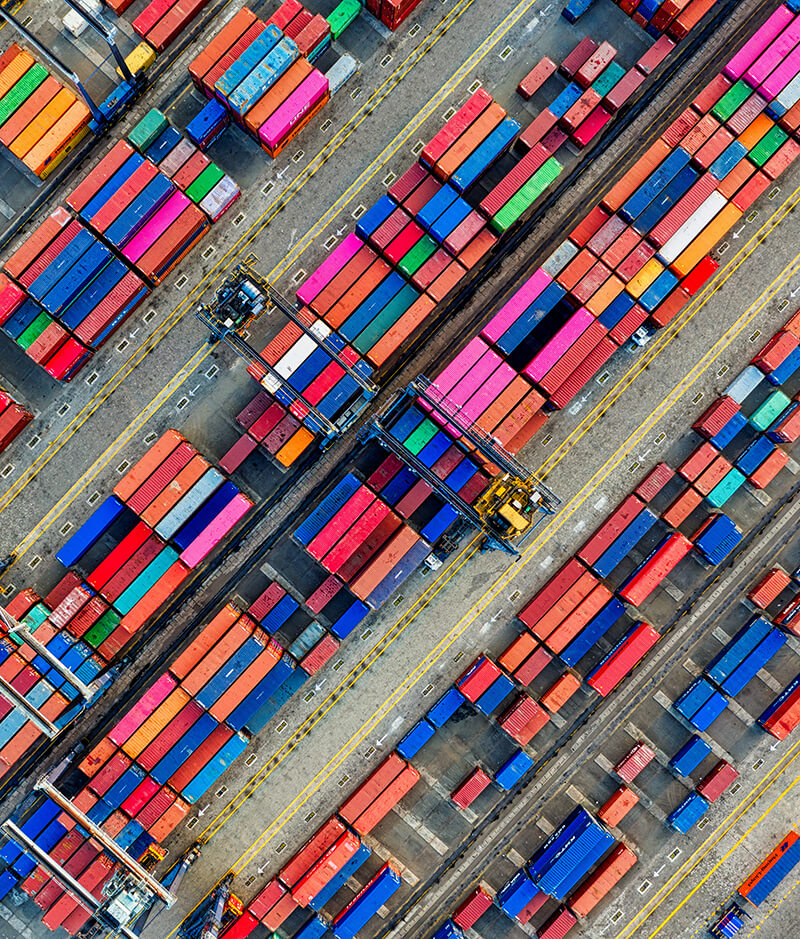

Our Goal is to Protect Our Clients by

Offering a Variety of Choices

In today’s world, cargo theft or damages are an unfortunate reality. Our goal is to protect our clients offering a verity of choices. Combining our efforts with several leading insurance companies allows us to offer quotes for cargo insurance as requested.

BUYING CARGO INSURANCE

Depending on the type of goods in transit, we strongly recommend buying a “Separate Cargo Policy.” This policy will cover you in the event of damages or loss.

- All Risk

- Warehouse to Warehouse

- Trade Show/Exhibition Coverage

- Long term warehouse/storage

- Coverage for terms of sale other than C.I.F.

THINGS TO KNOW ABOUT AIR & OCEAN CARRIERS LIABILITIES

“But isn’t the carrier responsible for any losses while they’re in possession of my cargo?”

This common misconception can lead to huge financial losses for shippers. The fact is that the liability of most carriers, freight forwarder & NVOCC, is severely limited by law and/or tariff restrictions. Generally, an ocean carrier is only responsible for up to $500 per package. An international air carrier has minimal per pound (or kilo) limit under whichever convention is adopted by the destination country. This is approximately $10.50 per pound (or $23.50 per kilo) under the Montreal Protocol 4, and only $9.07 per pound (or $20 per kilo) under the Warsaw Convention. Domestic air carriers are only liable for $.50 per pound for any shipment.

Having the right insurance will protect our clients from devastating losses.

VS IMPORT SERVICES, INC. LIMIT LIABILITY FOR ALL LOSS, DAMAGE, OR “MISS-SHIPMENT” SHALL NOT EXCEED $0.50 PER POUND, LIMITED TO A MAXIMUM OF $500.00 FOR ANY PACKAGE.